Residual Tax

If you were informed in August that you owe residual tax, you have an opportunity to save money.

Residual tax up to 16,981 DKK will be included in your deductions next year. This inclusion adds a 6% surcharge. For example, a residual tax of 16,981 DKK will cost you 18,000 DKK next year.

However, if you pay by November 20, you can avoid this surcharge, saving up to 1,019 DKK, equivalent to 6%.

- If your residual tax is less than 16,981 DKK, you can pay the full amount and save 6%.

- If your residual tax exceeds 16,981 DKK, 16,981 DKK is the maximum you can pay. The remaining amount will be billed separately in three installments.

Where to Find the Information

The amount included in next year’s deductions is listed on the first page of your Final Settlement. Details of the calculation can be found on the subsequent pages.

How to Pay

You can make a payment by bank transfer. The Tax Agency needs to know who is paying and for what. Since this payment option is referred to as a Section 5 payment, this term should be included. Your CPR number is required so we can identify the payer, along with the income year for the payment (usually the previous year).

Payments should be made to the Tax Agency’s account at Grønlandsbanken A/S:

- Reg. no. 6471

- Account no. 1002608

Please include the following in the payment message:

- Your CPR number

- The income year the payment relates to, e.g., 2023

- § 5

Example: 010101-0101 2023 § 5

Important - Note: Payment must be completed by November 20 and documented with a receipt or bank statement in case of questions.

Impact on Your Tax Card

When you pay by November 20, the Tax Agency can issue a tax card with the correct deductions. You will receive your tax card in your e-Boks in December.

Paying Residual Tax via Betalingsservice

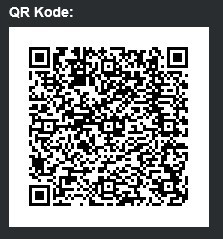

If you wish to pay residual tax through Betalingsservice, you can use this link to set up an agreement.